Why Every Homeowner Should Understand the Power of Texas Solar Incentives

Imagine opening your electricity bill and seeing the number drop month after month, or even discovering you’ve generated more energy than you used. This is not just a distant dream for Texans—it’s the reality for an increasing number of households and businesses embracing solar energy. Driven by rising utility rates and growing awareness of sustainable living, more people are asking how they can be rewarded for going green, especially in a state where the sun shines most of the year. Yet, the truth is that plenty of Texans still aren’t aware of the substantial incentives that make solar more accessible and affordable than ever before.

There’s a common misconception that solar energy is out of reach for the average family or that the upfront costs overshadow the potential savings. However, programs called Texas solar incentives were specifically designed to address those barriers, offering financial support, rebates, and free installation options depending on where you live and your choice of provider. Understanding what’s available can be the difference between waiting on the sidelines and starting to save money and make a positive impact right now. If you’re ready to see just how these incentives create new possibilities for homeowners and businesses alike, keep reading to learn how you can take advantage of what Texas has to offer.

Understanding Texas Solar Incentives: More Than Just Tax Credits

What exactly do “Texas solar incentives” mean for everyday Texans? Beyond the well-known federal solar tax credit—which allows homeowners to deduct a significant percentage of the installation cost from federal taxes—local incentives, utility rebates, and flexible financing programs add even more value. For instance, rebates from utility providers or city-specific programs can lower the cost of residential solar installation dramatically. Not only do these incentives make solar adoption practical for more budgets, but they also position Texas as a national leader in renewable energy usage.

But missing out on these perks means losing ground both financially and environmentally. Without access to these programs, homeowners could end up paying thousands more for the same clean energy or, worse, delay a smart investment that pays for itself in as little as a few years. The difference between being informed versus being left in the dark could impact decades of electricity costs and limit your ability to offset rising utility rates. Staying current on available Texas solar incentives ensures you’re making the most educated and financially responsible choice, especially as the energy landscape continues to evolve.

How Texas Solar Incentives Deliver Real Savings and Energy Independence

As a leading voice in the solar community, EcoGen America has spent years guiding Texans toward smarter, cleaner energy solutions. One of the most powerful benefits of Texas solar incentives is the immediate financial relief they offer—often through free installation, upfront rebates, and access to quality equipment without the hefty expense. These programs put solar power within reach for households that might have otherwise been priced out, breaking down the most common barriers to entry.

Furthermore, the value isn’t just in short-term savings. Solar incentives allow residents to lock in predictable electricity costs, protect themselves from future utility rate hikes, and sometimes even sell excess energy back to the grid. With so much sunlight available throughout the state, maximizing these financial supports means lowering your long-term expenses and investing in a future where your family or business isn’t at the mercy of unpredictable bills. Ultimately, these local and state-backed programs empower communities to take control of their energy production, develop lasting independence, and participate in a cleaner environment.

The Evolution of Solar Support: A Timeline of Incentives in Texas

It wasn’t long ago that solar panels were a rarity reserved for tech enthusiasts or eco-activists willing to bear high costs. However, as energy prices rose and technology advanced, state and local leaders in Texas began responding with innovative policies and incentive structures. From the launch of the federal Solar Investment Tax Credit—which is now extended through 2023—to the emergence of local municipal rebates and new zero-down financing options, access to solar energy has become democratized for more Texans every year.

As the renewable energy movement inches toward the mainstream, more utility companies and city planners are offering rebate programs, grid buy-back options, and educational resources that empower residents to move forward with confidence. Today, participation in solar initiatives isn’t just for early adopters—it’s a practical, mainstream solution for everyday homeowners and businesses looking to harness the sun’s power while securing major financial advantages.

Maximizing Incentives: Practical Steps for Texas Homeowners

Navigating the landscape of Texas solar incentives can initially feel overwhelming. The secret to getting the most value lies in partnering with local experts who understand the intricate web of state and municipal programs, utility-specific rebates, and federal credits. Starting with a free, personalized solar savings quote is often the smartest move—allowing you to see exactly how incentives would apply to your unique property and energy needs.

Being proactive means asking the right questions: Are there special city or county rebates available in my area? Can I benefit from no-cost installation options? How long is the current federal tax credit available? In Texas, with a strong network of local companies and energy advisors, credible resources help ensure no available dollar or cost-saving opportunity is left on the table. By approaching the transition with a plan—and tapping into up-to-date information—homeowners and businesses can maximize both financial and environmental rewards from day one.

Solar Energy as a Community Investment: Why It Matters for Texas

One of the most overlooked aspects of Texas solar incentives is their ripple effect on communities as a whole. When more residents and businesses make the switch to solar, local energy grids become more resilient and less dependent on fossil fuels or volatile market shifts. This, in turn, creates local jobs, boosts regional economies, and demonstrates leadership in environmental stewardship—values widely embraced throughout the state.

The result is more than just lower bills for individual homes; it’s a collective movement towards greater independence, sustainability, and future-focused growth. As homeowners experience cost savings, those funds stay within the community—often supporting neighborhood businesses, schools, and public works. In the long run, participating in Texas solar incentive programs is an investment not just in personal financial security but in a more sustainable and stable Texas for every generation.

EcoGen America’s Perspective: Local Knowledge, Trusted Guidance

At EcoGen America, there’s a commitment to making clean solar energy a reality for thousands of homeowners in Austin and across Central Texas. The company’s approach emphasizes both the highest-quality equipment and premium installation services, underpinned by years of experience navigating the market’s rapidly changing incentives. Their mission hinges on providing energy solutions that are accessible, financially sound, and built around the unique needs of each community they serve.

The guiding philosophy is rooted in the belief that everyone—regardless of location or income—should have access to technology that delivers real results. That’s why the process begins with education and a no-pressure conversation, helping people discover whether they qualify for free installation or other zero-cost solutions. Reliability, professionalism, and transparent communication are the cornerstones that have built EcoGen America’s reputation—ensuring every customer’s journey to solar is smooth, informed, and deeply rewarding.

By focusing on trust and tailored service, the company not only installs panels but also empowers homeowners with the information needed to make the smartest long-term decisions for their household or business. The outcome: a stronger, greener Texas where solar energy participation is the norm, not the exception.

What Success Looks Like: Real Experiences with Texas Solar Incentives

The true measure of an incentive program’s impact is found in the voices of those who’ve navigated the process. One recent homeowner reflected on the full journey from consultation to switch-on, highlighting how guidance, clarity, and professionalism transformed the experience. Their story resonates with countless Texans who are now discovering how solar power can upgrade their lives in practical and meaningful ways:

I couldn't be happier with my experience with my solar system. From the initial consultation to the final installation, their team was knowledgeable, professional, and courteous.

Outcomes like these aren’t the exception—they’re a growing reality for Texans who take action and explore the options available through Texas solar incentives. Success isn’t just about saving money; it’s about peace of mind, supporting local values, and gaining a level of independence that comes from making informed, impactful choices for your home or business.

What Texas Solar Incentives Mean for Your Future

The sunshine that dazzles Texas rooftops is more than just a symbol—it's a tangible resource that, with the right Texas solar incentives, can be transformed into savings, predictability, and opportunity. As programs expand and penalties for inaction mount in the form of rising utility bills, staying informed and proactive is the best move any homeowner or business can make. Through a blend of tradition and innovation, experts like EcoGen America are equipping Texans to lead the way toward a brighter, more independent future.

Access to Texas solar incentives means unlocking a pathway to greater energy freedom, environmental responsibility, and long-term value—making now the smartest time in history to consider solar power for your home or business.

Contact the Experts at EcoGen America

If you’d like to learn more about how Texas solar incentives could benefit your home or business, contact the team at EcoGen America.

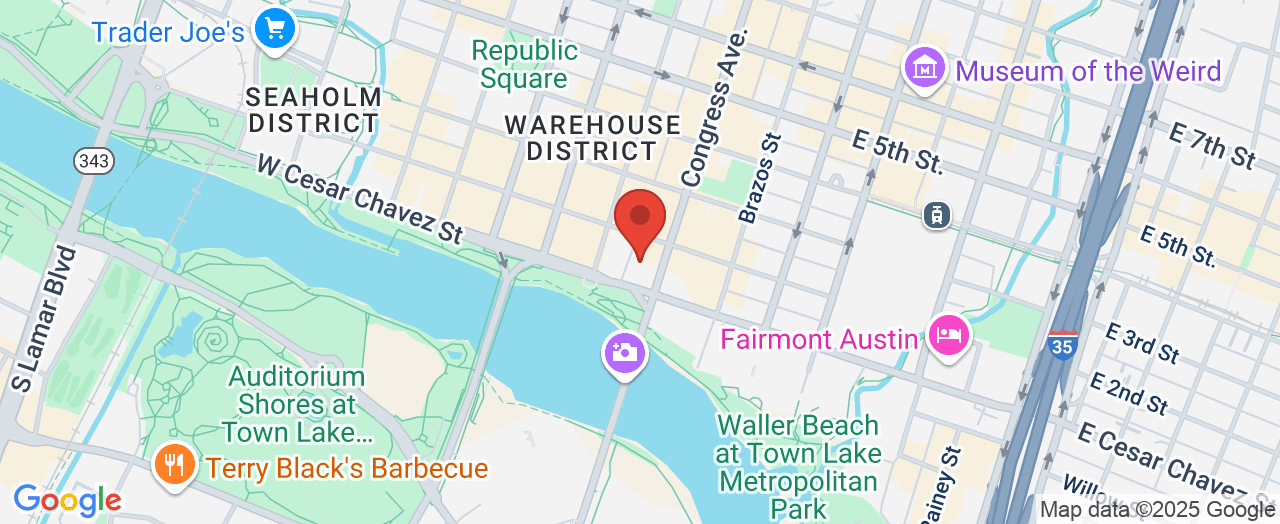

📍 Address: 100 Congress Ave. #230, Austin, TX 78701

📞 Phone: +1 888-294-5764

🌐 Website: https://ecogenamerica.com/residential/tx/austin/

EcoGen America: Austin Location and Hours

🕒 Hours of Operation:

Please contact EcoGen America directly for current business hours and to schedule a consultation.

Add Row

Add Row  Add

Add

Write A Comment