The Importance of Homeowners Insurance in New Hampshire

Homeowners insurance is not just a good idea; it is a necessity, especially in a state like New Hampshire, where home values have skyrocketed amid rising interest rates and economic factors. Currently, the average home in New Hampshire costs around $509,458, as reported by Zillow. This significant investment necessitates ample protection against disasters and unforeseen liabilities.

Best Homeowners Insurance Companies in 2025

Choosing the right homeowners insurance company can safeguard not just your belongings, but also your peace of mind. In 2025, several providers shine in New Hampshire for offering standout coverage options and exemplary customer service. Each company on our list is evaluated based on their track record in claims satisfaction, coverage options, and overall affordability. These insurance providers account for the state’s unique environmental factors such as snow, flooding, and even hurricanes.

How Costs Impact Your Homeownership Experience

Understanding the cost of homeowners insurance amidst New Hampshire's high property values is critical. With the property tax rate averaging 1.61%, owning a home can be financially taxing. Homeowners need to explore comprehensive coverage that not only protects their dwellings but also offers add-ons that can cover special circumstances, like severe weather damage, which is common in the area.

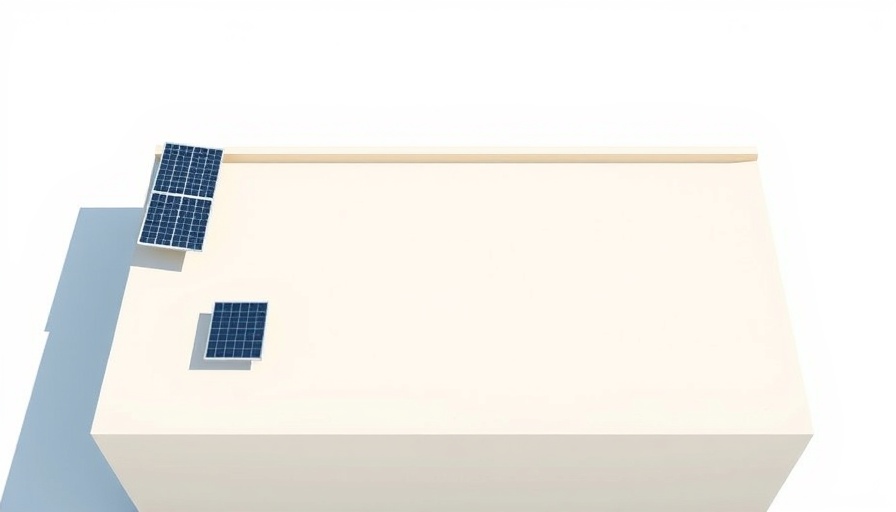

Supporting Your Solar Investment with Adequate Insurance

If you’re shifting toward a greener home by installing solar panels, ensuring that these systems are covered under your homeowners insurance is essential. While solar energy offers immense savings in the long-term, protecting your investment is key. Several insurance providers cater specifically to homeowners using renewable energy sources like solar, providing tailored coverage options that consider the unique risks and benefits associated with solar energy systems.

The Role of Bundling in Saving Money

Many homeowners are unaware of the advantages of bundling their insurance policies. By combining auto and homeowners insurance, not only can you save money, but you could also simplify your financial management. Many leading insurance providers feature discounts for bundled policies, which can greatly enhance your overall savings.

Actions You Can Take to Secure the Best Policy

To ensure you select the ideal homeowners insurance policy, make sure to do your homework. Begin with these actionable insights: compare multiple quotes, read customer reviews, and understand the coverage details before making a commitment. This proactive approach can significantly impact your financial security and satisfaction as a homeowner.

Overall, having the right homeowners insurance in New Hampshire is an imperative part of protecting your family and investment. With economic variables at play, being informed and diligent can yield enhanced returns on your home's value and long-term expenses.

Don't wait to secure your peace of mind. Start comparing the available homeowners insurance options today and ensure that your biggest investment is well protected for years to come!

Add Row

Add Row  Add

Add

Write A Comment